SMSF Lending

Take Control of Your Super Fund

Kingslend Financial provides streamlined broking services to help you get self managed super fund loans.

SMSF Lending

Take Control of Your Super Fund

Kingslend Financial provides streamlined broking services to help you get self managed super fund loans.

Leverage Your Super

Fund Your Investments

Competitive Rates & Terms

Did you know you can tap into your super funds to invest in property?

A Self-Managed Super Fund (SMSF) gives you control over how your retirement funds are invested. An SMSF is set up with the help of an accountant or financial advisor.

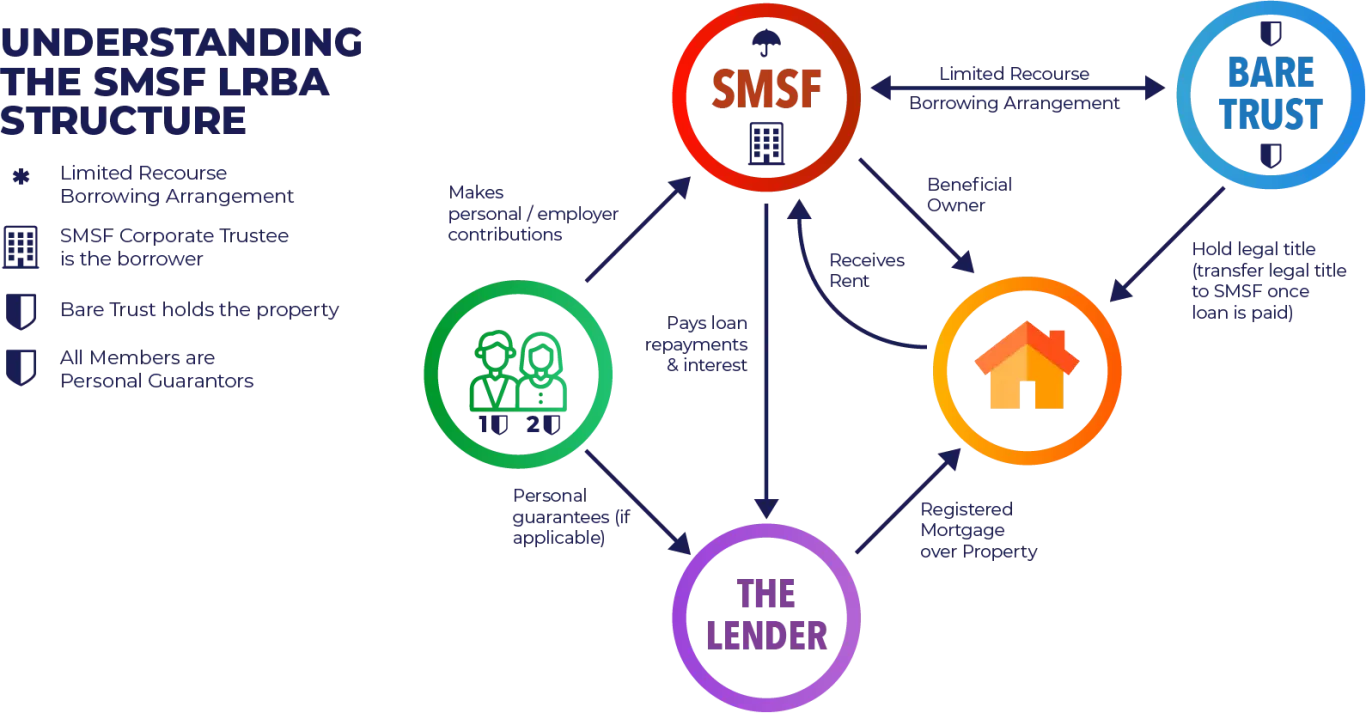

In some cases SMSFs may be able to borrow money in order to purchase property. The returns on investment (either capital growth or rental income) are then channelled back into the SMSF to boost your retirement savings.

Getting an SMSF loan requires a specialist broker.

Most major banks won’t lend to a SMSF. You need a broker who can help you find the most suitable loan provider to either purchase or refinance.

SMSF loans are very complex and a specialist broker can give your application the best chance at success and structure you loan for your exact needs.

With Kingslend Financial, you will get

Discover the Best Offers

With SMSF loans there can be big differences in rates and terms between lenders. We work hard to get you the right deal.

Complex Process Made Simple

There are strict regulations and tax implications with SMSF loans, so we work alongside your accountant or financial advisor to create a seamless process.

Loans Structured for Investments

It’s important that the SMSF loan terms are secured for your situation and future goals. We take that all into account.

Relationship Focused

We offer lifetime support for all of your loans.

With Kingslend Financial, you will get

Mortgages Structured for Savvy Investments

We keep your big picture goals at the forefront and help you achieve them.

Pre-Approval within 2 Weeks

It might even be less! We want to help you be ready to jump at the perfect opportunity.

No Fees to You

We are paid by the banks for introducing loan applications and for doing the work that would otherwise be completed by one of their staff.

Annual Mortgage Health Check

We are committed to making sure you get the right loan and rates in the short and long term.

How It Works

Schedule a Discovery Session

We’ll help you understand your positions and objectives.

Get Competitive Loan Options

We find you the right SMSF lenders and fight for the best deal.

Boost Your Retirement Savings

Leverage your SMSF and retire with comfort.

Frequently Asked Questions

What is the loan to value ratio typical for SMSF Lending?

How will the banks assess how much my SMSF can borrow?

- Current income of the SMSF

- Tax returns

- Rental yield of investment property

- Income and payslips